Planning for 2026: The Financial Benefits of In-Home Care for Greenville Seniors

As we approach 2026, many Greenville families are asking themselves a question that keeps them up at night: "How can we afford quality care for Mom or Dad while respecting their wish to stay home?"

If you're one of the thousands of adult children in the Upstate navigating this reality, you're not alone. And here's something that might surprise you: in-home care isn't just about comfort and independence—it can actually be the most financially smart decision you make for your family.

The Real Cost of "Doing Nothing"

Let's discuss what financial advisors often overlook: the hidden costs of delaying care decisions.

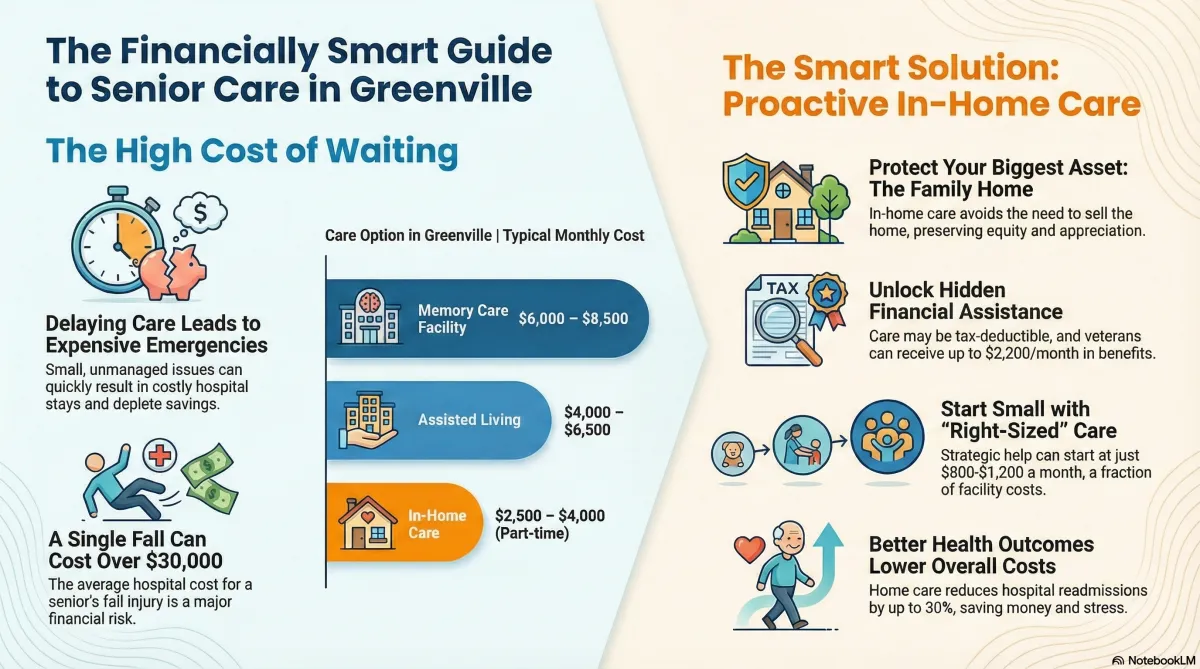

When seniors try to manage alone without support, small problems become expensive emergencies. A fall leads to a hospital stay. Missed medications result in complications. Skipped meals lead to malnutrition and another ER visit. Each incident chips away at savings that took a lifetime to build.

According to the National Council on Aging, one in four seniors falls each year, and the average hospital cost for a fall injury exceeds $30,000. Suddenly, that monthly investment in home care starts looking less like an expense and more like an insurance policy.

Breaking Down the True Cost Comparison

Assisted Living in Greenville: $4,000–$6,500/month for a basic apartment

Memory Care Facilities: $6,000–$8,500/month

In-Home Care (part-time): $2,500–$4,000/month for 20-30 hours/week

In-Home Care (full-time): $6,000–$8,000/month with a live-in arrangement

But here's what those numbers don't show: When your parent stays home, they're not paying rent in two places. They're not selling the family home at a loss during a stressful transition. They're not spending thousands on "move-in fees" that you'll never see again.

The Tax Advantages Nobody Talks About

Did you know that in-home care can be tax-deductible as a medical expense? If your parent qualifies for care due to chronic illness or inability to perform daily living activities, those costs may exceed the IRS threshold and provide real tax relief.

Additionally, programs like Veterans Aid & Attendance benefits can provide up to $2,200/month for qualifying veterans or surviving spouses to offset home care costs. Many Greenville families leave this money on the table simply because they don't know how to ask.

Protecting Assets While Planning Ahead

Here's where the wisdom of experts like Virginia Morris (author of How to Care for Aging Parents) becomes invaluable: planning early protects wealth.

When families wait until a crisis hits to arrange care, they make expensive, rushed decisions. But when you plan now for 2026, you can:

Preserve home equity by keeping your parent in their residence while property values appreciate

Qualify for Medicaid look-back periods (5 years in South Carolina) if long-term care eventually becomes necessary

Structure care incrementally, starting with a few hours per week and scaling up only as needed

Avoid the "spend-down" trap that forces families to deplete assets before accessing facility care

The Greenville Advantage: Local Resources That Save Money

One of the best-kept secrets in the Upstate? We have incredible local resources that can help you stretch your care dollars further.

Connections to Care (864-549-0023) specializes in connecting Greenville families with vetted, trustworthy caregivers who understand our community. Unlike national franchises that take 50-60% markups, working with a local care coordinator means more of your money goes directly to quality care.

The South Carolina Department on Aging offers programs like Care Connections that provide free care coordination and can help identify cost-saving programs you qualify for.

Meals on Wheels of Greenville delivers nutritious meals for as little as $6 each—far less expensive than the alternative of hiring someone to shop and cook, or dealing with the health consequences of poor nutrition.

The "Right-Sizing" Approach to Care

Here's a concept the experts at the Aging Life Care Association teach: you don't need to go from zero to full-time care overnight.

Start with what geriatric care managers call "strategic support"—the specific help that makes the biggest difference:

Medication management visits (2-3 times/week): $100-150/week

Meal preparation and companionship (3 days/week): $300-400/week

Transportation to appointments (as needed): $25-40/hour

Light housekeeping and safety checks (weekly): $100-150/week

This "right-sized" approach often costs $800-1,200/month—less than a third of facility care—while preventing the problems that lead to expensive interventions.

What the Research Really Shows

Dr. Atul Gawande's groundbreaking work in Being Mortal revealed something insurance companies don't advertise: seniors who maintain autonomy and purpose live longer, healthier lives with fewer medical complications.

When your mother can still tend her garden in her Greenville backyard, when your father can sit on his own porch watching the Blue Ridge Mountains, they're not just happier—they're medically better off. And that translates directly to lower healthcare costs.

The data backs this up: home-based care reduces hospital readmissions by up to 30% and can delay nursing home placement by an average of 2-3 years.

Planning Your 2026 Care Budget

As you look ahead to the new year, here's a practical framework:

January-March 2026: Assess current needs and establish baseline care (start small)

April-June 2026: Evaluate what's working; adjust hours or services as needed

July-September 2026: Review finances; take advantage of mid-year tax planning opportunities

October-December 2026: Plan for the following year; adjust for any changes in health or family circumstances

The Conversation That Changes Everything

The hardest part isn't the money—it's the conversation. As families throughout Greenville know, talking to parents about accepting help requires sensitivity and timing.

Start with what matters to them: "Dad, I know you want to stay in your home. Let's talk about how we can make that possible for as long as you want."

Frame care not as loss of independence, but as the tool that preserves it.

Your Next Step

If you're reading this and thinking, "We need to plan now, not later," reach out to Connections to Care at (864) 549-0023 or [email protected]. They offer free consultations to help Greenville families understand their options without any pressure or obligation.

Because here's the truth: the best time to plan for care was five years ago. The second-best time is today.

Your parents spent decades planning for your future. Now it's time to honor them by planning thoughtfully for theirs—in a way that protects both their dignity and the financial security they worked so hard to build.